Commodity Price Forecasts using ML driven Insights

3AI October 17, 2022

Featured Article:

Dependency on Commodities and Associated Risks:

Companies with Agricultural commodities as their core raw material face several risks in supply security. Agricultural commodities not only suffer from the risks associated with market dynamics like all other commodities but are also impacted by environmental factors making them even more volatile and the risks higher. The commodities we procure saw an escalation of almost $2Bn in spend with comparison to last year. Covid led logistical disruptions and geopolitical tensions in major agricultural powerhouse has only added to the above uncertainty.

A price forecasting model would: –

- Take correct positions in financial market

- Procure commodities efficiently, &

- Save losses and opportunity costs

Problems Faced by Procurement

To ensure supply security, Agricultural commodities are booked in advance in alignment with a risk mitigation policy to ensure the company secures the required volumes at an ideal price, without impacting production.

We focused on Barley, which is a key ingredient for beer and saw an increase of 61% in prices from 2020 to 2022.

Procurement faces a few keys issues while fixing prices for barley:

- What is the ideal price to buy barley?

- What are the main factors that impact the prices of barley?

- What is the best time to buy barley?

- How much quantity of barley needs to be bought for ideal inventory and best price?

While for some agricultural commodities like corn and wheat, we have spot prices and future contracts, making it easier to analyze the market. The same information is not available for commodities like barley, making it difficult to anticipate price movements and hedge risk.

Gut Decisions to Data Driven Decisions

Market speculations, supplier intelligence and category knowledge are key factors that would facilitate decision making if an analytical approach is not followed.

A price prediction model helps us make informed business decisions and develop data-driven strategies to reduce procurement costs

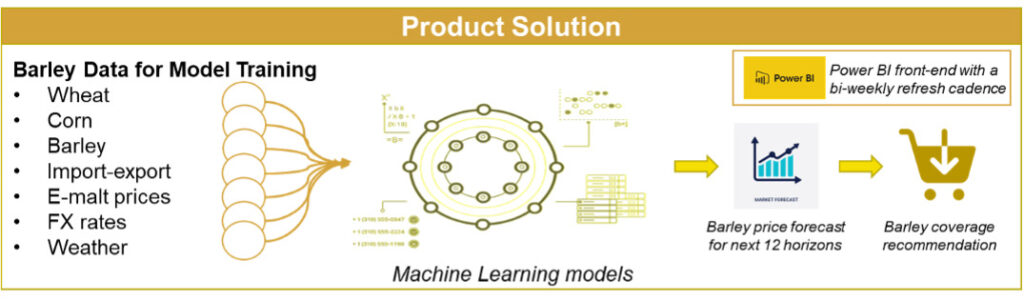

There are 3 key Components of the Product:

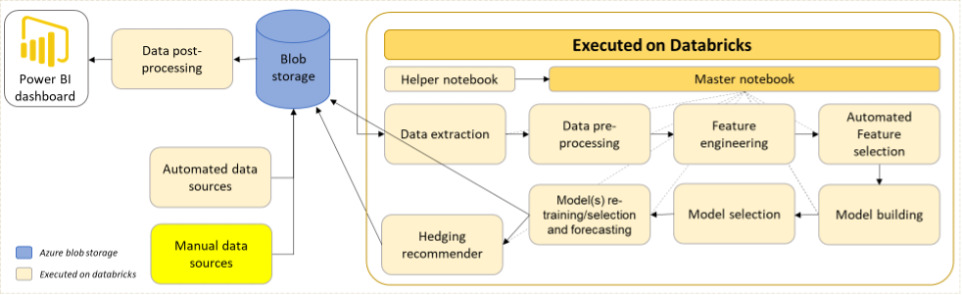

- Price Forecasting Model: Identified and studied data from different agriculture commodities, weather, NDVI data, trade dynamics and macro-economic factors to understand the impact on the barley prices.

Univariate and Multivariate time series forecasting techniques are leveraged to forecast Barley prices for the next 12 weeks and extract drivers for change. Factors driving the movement of prices up and down are extracted from the model, to quantify impact of external factors

- Hedging Recommender: Based on the trend of the forecasted prices, a mathematical linear optimizer is built that recommends the optimum volume that should be purchased to reduce spend, mitigate risk and enable savings opportunity.

- Product Front-end: To productize the solution and make the results more interpretable, the front end for the solution not only displays the results for the forecasted prices and volume recommendations but is also updated with market information, accuracy of the model and opportunity identified. The product helps build a narrative to share forecasted prices, explain the reasoning behind the forecasts, complement them with price movements for representative commodities while being transparent about the historical performance of the model.

Continuous Integration/Continuous Deployment pipeline has been set-up and completely automated to refresh the product. This will help us share model forecasts quickly while also drastically reducing the time to scale the product.

Industry & team achievements

The price forecasting model built for barley has outperformed industry standards, with significantly better directional accuracy and MAPE. Over a 1.5-year period (since the beginning of 2021), the model has an average accuracy of 97.3% for the next week forecast, with the 12-week average accuracy being an industry leading 91.8%.

ROI delivered:

The product identified savings opportunities of $2.4Mn for Western Europe for the year 2021.In the first half of 2022 the product has been able to avoid cost of $6.35 Mn. The product is also providing historically back-tested results which is pushing business to re-assess internal procurement policies.

Rewards and Recognitions:

As a result of such impressive results, the model has been presented as a flagship tech product for our procurement business and has also been recognized at Express Logistics and Supply Conclave as the best product in the “Best Use of Analytics in Demand Planning & Forecasting Practices”

Conclusion and Key Learnings:

While building a model for a commodity there are a few key points that should be considered. These are learnings collected during the process of building the product and integrating it into business.

- Intensive Data Study: Several factors directly and indirectly impact Agriculture Commodities, most variables are highly correlated and certain variables are difficult to analyze quantitatively, like soil health, but significantly impact the model. Study and analyze the data to select the key variables that have the most impact.

- Scalable Product: Agricultural Commodities are impacted by very similar factors with very few exceptions and the product should be able to be expanded to include several commodities and several regions providing a wholesome view of the market.

- Weekly Update: The product should be refreshed at a weekly cadence for better visibility into a volatile market and facilitate decision making which directly impact the bottom-line of the company.

What’s Next?

With agricultural commodity prices showing unprecedented volatility, with their prices reaching new heights, the need for a time series forecasting model, which can assess the market and forecast volatility becomes extremely important to reduce costs. The current product is now being scaled to other commodities, prioritized with the DVF framework.

Our aim is to build a single platform to help business manage end-to-end procurement of commodities leveraging ML driven insights and recommendations to optimize spend, mitigate risk and ensure supply security.

Title picture source: freepik.com