Reimagine Banking with Analytics: Part 1

3AI November 4, 2020

In the last few years, as is the common trend of evolution among different verticals, Banking, Financial Services & Insurance is undergoing a transition from product-based and transaction-based to a customer-centric business model, and the evolution of digital is responsible for much of it. Multi-channel engagement for customers to take care of their financial objectives has become key to maximizing customer engagement, improve customer experience, and reduce attrition, which is directly related to creating newer and more innovative revenue streams for banks. The Digital platform will impact the entire financial ecosystem by necessitating new internal business processes and instilling new employee skills to support these operations.

Reasons for Increased Digital Adoption

Security & Risk Assessment In Post Financial Crisis Topography

Post Financial Crisis landscape has left the financial institutions with a tougher and more challenging operating environment. Scarcity of capital has led to the need of a tighter focus on operational efficiency and taking decisions that capital adjusted and risk informed. This has put pressure on financial firms to raise their capacity to understand financial risks well and act on insights in real time.

Customers Are Getting Tech Savvy

Customers are going digital and becoming more tech savvy, more demanding and more flexible in transitioning to competitors in case their expectations are not met. Increasing use of mobile phones and other emerging technologies has seen a surge in banking transactions, leading to generation of huge amounts of data for banks on a daily basis. Analysis of this big data presents great prospects to the banking industry to churn insights which will lead to new revenue stream and lesser operational costs.

New Regulatory Norms

Multiple regulations, local as well as global, have forced the banks to implement technology enabled data management. Regulators, who were fine with standard reports on regular intervals are now demanding access to granular level data for a better, clear view on the bank’s risk assessment. The multiplicity of regulation aspects that have come to highlight, like anti-money laundering, Basel norms, Foreign Account Tax Compliance Act, etc. has forced banks to implement sophisticated data management systems since these regulations call for providing accurate and reliable data in a timely manner to the regulators.

A New Disruptive Landscape in Banking

The digital adoption trend has setup a completely new competitive environment, with a complicated world of partners and competitors. Entry of small internet-only banks, online payment models like PayPal, financial management firms, and scores of Non-traditional players has set the traditional financial structures scrambling to figure out how they can co-exist among this extended financial eco-system. Though financial modes like Social Media, E-commerce companies, and mobile phone providers are being considered more of partners, others like internet banks, Big Retail Banks and Financial Management Firms are being perceived more as competitors.

Tech-Savvy Customers & Rise of Mobile Banking

82% of retail bankers agree or agree strongly that in the next five years mobile will become the number one channel for millennial and younger consumers—banks’ future customers.

– EIU’s executive survey

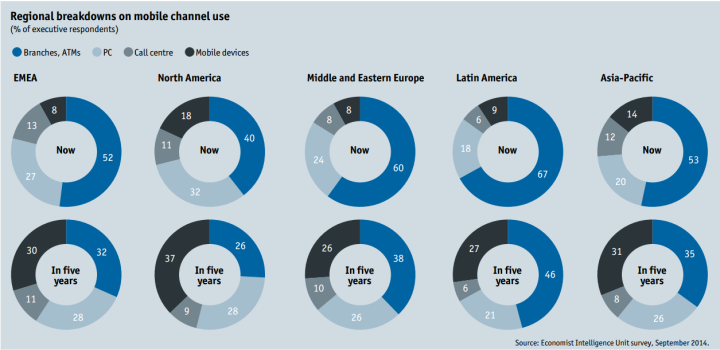

Mobile devices are becoming the primary channel of Customer Interaction for both C2C and C2B interface. Banking, like so many other verticals, has been significantly influenced by the increasingly mobile lifestyle. Both bankers and consumers expect the use of mobile-banking technologies to grow rapidly.

The Move to Omni channel Customer Engagement

Even though adoption of mobile channel among customers is poised to grow, other channels where consumers and banks connect, like Online, ATMs, branches, etc. will continue to remain important. Many consumers, especially those coming from older generations, still prefer brick-and-mortar branches over mobile and online channels due to the inherent psychological feeling of stability and dogmatic compliance that comes with it. This demography would also prefer ATMs over other digital payment-models because of the inherent appearance of better security and reliability.

“Interaction via mobile devices will continue to grow quickly but banking as a whole will always remain omnichannel”

Consumers are not uniform in their banking medium: the baby boomers, the millennial, the retirees, each one is inclined to use a different set of channels in no specific order. The multiplicity of channels persists because no channel is a perfect substitute for the other. Thus banks will have to setup, not only in mobile systems but all the other channels and provide a layer of integrating to one another so customers can choose their own preferred medium of financial transaction and move seamlessly between them. Only 15% of respondents say they have achieved full multi-channel integration for now , but this number is set to rise to 75% by 2019.

Moreover, mobile services could help make developing countries and the underbanked and unbanked areas more accessible and attractive markets to banks. By 2015, approximately 1.2bn mobile users will use mobile money or some form of mobile wallets In emerging markets. This is a big move forward compared from five years back when there were no systems in place for it.

“ Almost 40% of the underbanked use mobile transaction services at a relatively high rate”

– “Consumers and Mobile Financial Services 2014”, 2014 Federal Reserve Study

The Evolving Digital Customer Expectations

The general affinity of customers to move to digital is not enough for them to adopt mobile services in BFSI Industry. It also depends on providing a compelling experience, which means providing a spectrum of value-added services beyond the basic transactional requirements. With the ever-increasing quality of services the customers are being exposed to, from the big internet companies, almost two-thirds of the customers now expect the same experience from the Retail banking sector. Add to that the constant disruption by non-traditional sources like “mobile wallets” which is increasing the disintermediation for them.

The customer expectations are only set to increase further as years pass on, with demand increasing for more advanced features like spending analysis and insights, wealth-management capabilities, simplifying and completely digitizing new account opening process, customized offers and perquisites , extended mobile wallet functionality for C2C transactions, legal advice and insurance insights.

Consumers believe that banks can be most helpful to them in saving and investing. Around 60% say banks could help them save better, while around 75% expect banks to assist them in investing more wisely. What is even more a bad news for the Financial firms is that non-resolution of these expectations would lead to a huge missed opportunity for them, as customers could, very easily and organically, substitute them with other non-traditional solutions to help them with spending and budgeting decisions.

Benefits of Digital Adoption

- By pushing low-value transactions to mobile, banks can greatly lower operating costs and improve efficiency and quality of service, which can help them grow their businesses significantly, and capture new customers.

- The routine, commodity transactions can be managed by digital products like mobile wallets, which can be leveraged as a platform for selling higher-value-added services like loans and deepen relationship.

- Better customer experience by issuing a spectrum of value-added services focusing on customer and his needs, like real-time alerts and any-time instant customer service.

In the next blog post, we will see how adoption of Analytics over the digital platform is going to leverage scalable benefits for financial firms instead of incremental outcome.