Left Shift Decisioning – a Paradigm Shift and a Key Differentiator for Banks in Recessionary Environment

3AI March 20, 2023

Featured Article:

Author: Aditya Khandekar, President, Corridor Platforms India

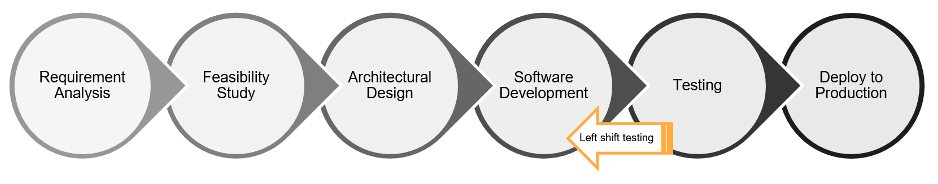

Left Shift – A software development concept

The core concept of left shifting started from testing, where we shift the testing phase to earlier phases in the software life cycle. The goal is to test early, fix bugs close to source of issue and prevent backloading of bugs. However, this concept broadly applies to all aspects of a software development, for example, well-structured requirement will reduce the downstream back and forth between product managers and developers. As we move further down in the software development lifecycle, the resolutions become more costly.

To make this paradigm shift – using testing to illustrate, developers do more structured and robust unit testing upfront to improve quality upstream, lessening the load on testing team downstream.

Impact: If implemented successfully it results in:

- Faster iterative cycles for new features in agile development

- Lower cost and effort

- Shortens time-to-market

- Better stability and quality of end-product

Left Shift Decisioning – the What?

Before we dig-in, here are some examples of decisioning for banking:

- Prospecting: Should I make an offer to a prospect for an installment loan?

- Underwriting: Should I approve the installment loan and at what rate, amount and term?

- Customer Management: How should I restructure the loan terms for a customer facing financial hardship?

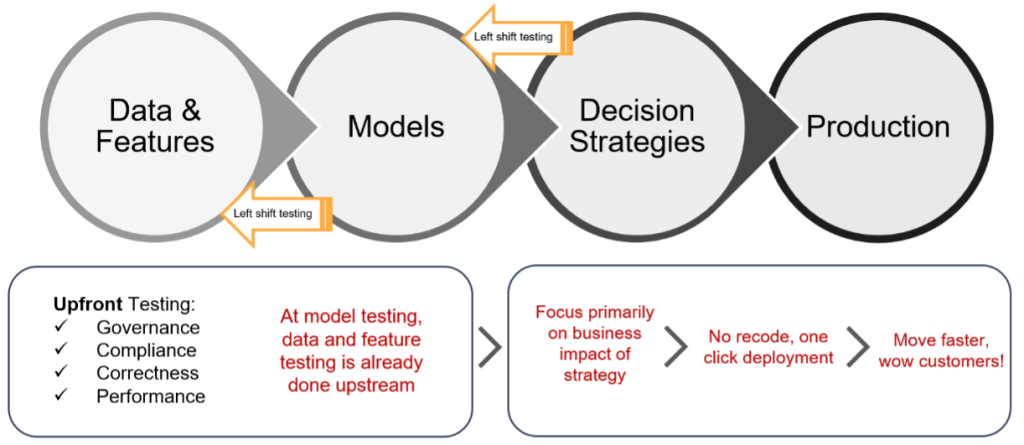

Concept: A decision build lifecycle has 4 distinct steps as described in the infographic below. At each

step there is a requirement of ‘testing’ like software development testing. To illustrate with few examples (not exhaustive) on the ‘Data and Features’ step, some the key testing steps are:

- Data and Features testing (list not exhaustive):

- Governance:

- Role governance: Limits access of data by class of users, example PII (Personally Identifiable data) can be seen by few restricted roles.

- Compliance:

- Distribution check: Checking to ensure data distribution is meeting expectations including checks for outlier or bad data.

- Correctness:

- Logic check: Ensuring that logic of feature definition is correct and is not duplicated already in the feature library.

- Performance:

- Performance check: Checks to ensure that code would run in production in a performant way on large datasets.

- Left Shift Testing for Decisions:

- Model Level: As a business and compliance check, if the process is setup that all features that are driving a model have been tested ‘at-source’ and have been approved upstream once for use many times downstream, this can dramatically improve the quality and efficiency of the testing process at the model level. Note this also applies to associated governance and compliance of data and features upstream which is completed as part of the approval process.

The model checks can now focus on model related testing like soundness, MRM, Fair Lending Compliance and business impact of models with various scenarios while having comfort that underlying features do not need further checks.

- Strategy Level: On similar lines, if the models and features driving models have been approved ‘at-source’ upstream, the strategy testing can focus on areas of business impact, sensitivity of outcomes to various scenarios.

This implication of this is, changes to strategies in volatile environment can be thoroughly tested with focus and approved quickly before being moved to production while having comfort that features and models upstream do not need further checks.

Impact: If implemented successfully it will result in:

- Faster iterations of decision strategies with focus on areas of high risk or impact

- Shortens time-to-market for decisions

- Lower operational & regulatory risk

- Sustained differentiation by being more ‘proactive’

Left Shifting Decisioning – Why is this so important in the current recessionary environment?

There has been a dramatic shift during the last 10 years towards digital only originations for credit. Customers are asking for real-time decisioning, with instantaneous approvals for contextual offers and services. Customers have the ability to compare offers and services across banks to make their final decisions. This implies two things, a. Banks with sub optimal decisioning capabilities could potentially lose out on good customers or get adverse select (in recessionary times) and b. product acceptance rates can be significantly lower due to competition with best-in-class banks (in digital marketplace) as well as disconnect to customer’s needs. Banks need to be able to react quickly to these dynamics to stay competitive.

If banks are able re-engineer their build, evaluate, and approve decision process with left shift decision paradigm, they will perform only relevant business analysis and compliance checks at each iteration more thoroughly versus testing for everything. Hence, they will shorten reaction time to competitor moves and customer needs while reducing overall potential for regulatory and reputational risk.

This can become a sustain differentiator in a volatile recessionary environment currently where best-in-class implementors of left shift decisioning paradigm can gain unproportional market share and win against lagging competitors.

Title picture: freepik.com